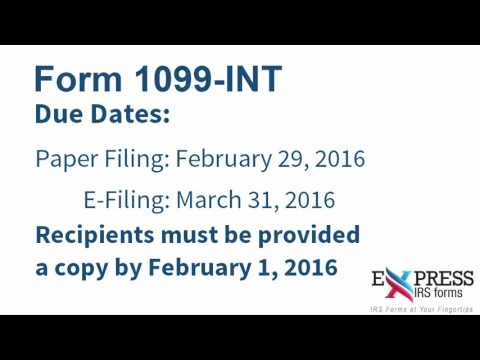

Welcome to Express IRS forms. Form 1099 int for interest income serves as a yearly tax statement from payers of interest income. It summarizes income of more than $10 from interest alongside associated expenses. The due date for paper filing form 1099 int is February 29, 2016. If you choose to e-file form 1099 int, the due date is automatically extended to March 31st, 2016. Please keep in mind that this form must be provided to the recipient and a copy mailed to or filed with the IRS no later than February 1st, 2016. Form 1099 int for interest income must be filled out for each person who was paid reportable amounts, who you withheld and paid any foreign tax on interest, and who you overpaid but did not refund any federal income tax from under the backup withholding rules. Regardless of the amount of the payment, only report interest payments made in the course of your trade or business and nonprofit activities. The IRS encourages e-filing for this information return and mandates that anyone filing 250 or more must file these returns electronically. To learn more about how you can e-file your information returns, such as form 1099, with the IRS, you can go to Express IRS forms.com. If you have any questions in regards to e-filing your information returns, please contact our dedicated customer support team at 704-839-2270 or send an email to support@expressirsforms.com.

Award-winning PDF software

1099 2025 Form: What You Should Know

Form 1099-MISC—Red leaf Press Please copy all numbers on the top of the back form, in the white box labeled “Copy to Taxpayer.” Paying for a home office with a lease You can deduct the cost of hiring a qualified contractor to complete the interior design or renovation of your home office if the home office is located in a common area. Paying yourself a bonus If you receive a bonus that is not taxed as income, you can deduct it as a business expense. Be sure to include in your Form 1040 the appropriate Forms W-2 and 1099, if applicable. 2016 Notes on a Form 1099-MISC 2016 Notes on 2025 Form 1099-MISC (PDF) Here are notes on 2025 Form 1099-MISC, which I updated for 2018. 2015 Notes on 2025 Form 1099-MISC (PDF) Here are notes on 2025 Form 1099-MISC, which I updated for 2017. 2015 Notes on 2025 Form 1099-MISC (PDF) Here are notes on 2025 Form 1099-MISC, which I updated for 2025 and 2017. The Form 1099-MISC is not supposed to be a schedule. You use the schedule if your total expense is 500 or more. When the Schedule is a schedule, you should use the Form 1099 for the entire year. Form 1099-MISC also refers specifically to the amounts in box 2 and 3 of Part I of Form 1099-MISC. You can receive Form 1099-MISC from a business. If you provide your employer with a Form 1099-MISC, that Form must be signed by you, or any other party whose name is listed on the Form. If you receive a Form 1099-MISC from the U.S. Internal Revenue Service (IRS) and it is signed by someone else who did not receive a Form 1099-MISC from you, that signature is not valid, and you must sign the form. The Form 1099-MISC report that you file with your employment tax return is part of the employer and income tax return. The amount on a report that you mail is reported on Form 1099-MISC. The amount on Form 1099-MISC that you receive is not part of the employer's and income tax return.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do IRS 1099-MISC 2014, steer clear of blunders along with furnish it in a timely manner:

How to complete any IRS 1099-MISC 2025 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your IRS 1099-MISC 2025 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your IRS 1099-MISC 2025 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 1099 form 2025